Climate-related risks and opportunities

Recognition method

Scenario selection and analysis process

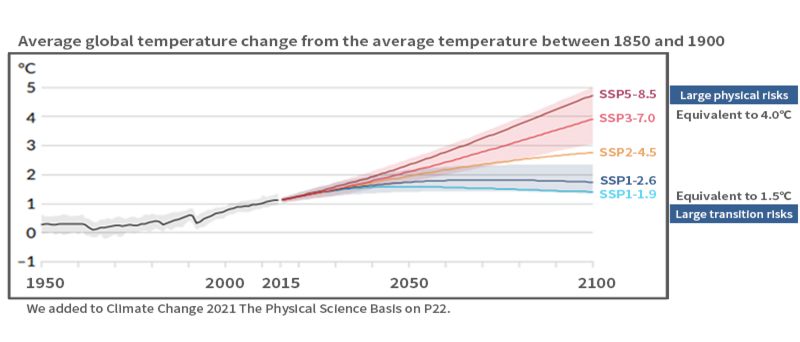

Our group recognizes climate change-related risks as an important issue that has a significant impact on our business activities, and we believe that there are two areas in which the average global temperature will rise by +1.5℃ and +4℃ compared to pre-industrial revolution levels. We selected a scenario and conducted a scenario analysis for the next 10 years. In order to identify the risks and opportunities that climate change poses to our business, and to consider strategies to address them, our group uses the "Net Zero Emissions by 2050 Scenario (NZE Scenario)" announced by the International Energy Agency (IEA) in 2021. Global warming scenario (RCP8.5) according to the UN's IPCC (Intergovernmental Panel on Climate Change)'s Fifth Assessment Report (published in 2014) and the Earth according to the Sixth Assessment Report (published in 2021) The global warming scenario (SSP5-8.5) is used as a reference.

Scenarios used as reference for scenario analysis and reasons for their selection

| Selected scenario | Reason for selection |

|---|---|

| IEA “Net Zero Emissions by 2050 Scenario” 2021 | In support of the Paris Agreement and Japan's Nationally Determined Contribution (NDC), and based on the decisions made at COP26 (the 26th Conference of the Parties to the United Nations Framework Convention on Climate Change), we have adopted a scenario that aims to achieve zero emissions before 2050. "Net Zero Emissions by 2050 Scenario" is selected. |

| IPCC “Fifth Assessment Report (2014)” IPCC “Sixth Assessment Report (2021)” |

We have selected "RCP8.5" and "SSP5-8.5", which have undergone extreme "physical changes" and have a large impact on business activities. |

IPCC climate change scenarios

Using these scenarios as a reference, we extracted multiple factors that may have an impact on our group's business, calculated the period until they materialize, and the degree of impact on our group. We also considered countermeasures for items of high strategic importance.

These processes are reviewed by the Sustainability Promotion Committee, taking into account the opinions of external experts, and reported to the Board of Directors.

Climate-related risks and opportunities assessment scale

When considering climate-related risks and opportunities, we categorize the period until an event materializes into "short term" (less than 3 years), "medium term" (3 years to less than 10 years), and "long term" (10 years or more). Classified into 3 levels. Regarding the degree of impact on our group, based on the disclosure standards of the Tokyo Stock Exchange, we will evaluate the impact to be "major" (±10% or more of consolidated sales revenue or ±30% or more of consolidated profit before tax), We evaluate companies in three levels: "medium" (±5% or more of consolidated sales revenue or ±20% or more of consolidated profit before tax) and "small" (±10% or more of consolidated profit before tax).

Evaluation scale (period until the event manifests)

| Classification | Period until manifestation (approximate) |

|---|---|

| Short term | Less than 3 years |

| Middle period | More than 3 years but less than 10 years |

| Long term | Over 10 years |

Evaluation scale (degree of impact on our group)

| Classification | Degree of impact on our group (estimate) |

|---|---|

| Big | ±10% or more of consolidated sales revenue or ±30% or more of consolidated profit before tax |

| During ~ | ±5% or more of consolidated sales revenue or ±20% or more of consolidated profit before tax |

| Small | ±10% or more of consolidated profit before tax |

Climate-related risks and opportunities

Impact analysis results

Based on the two scenarios mentioned above, the impact analysis results of climate-related risks and opportunities (scenario analysis results) are shown in the table below, "Impact analysis results of climate-related risks and opportunities." Our group operates a wide range of businesses, centering on the housing business, but based on the importance of the single-family housing business (*1) and forestry business (*2) based on scenario analysis, we decided to We identify "risks" that may have an impact on the company's business and "opportunities" that may lead to an increase in corporate value.

- *1 Single-family housing business refers to the single-family house sales business and the custom-built housing business that supplies wooden houses.

- *2 Forest business is a business that manages forests, harvests timber, and processes lumber.

1. Single-family housing business

Our group supplies more than 40,000 single-family homes annually. The single-family housing business is greatly affected by environmental regulations and other factors imposed on the housing itself.

In addition, because the amount of building materials procured is large and the types are diverse, the introduction of carbon taxes and other measures to regulate emissions and increase the cost of environmental measures will have an impact on material costs.

[1] 1.5℃ scenario

[Policies/Legal Regulations] Energy saving/low carbon regulations

In the 1.5℃ scenario, it is assumed that all newly built houses will be ZEH (Net Zero Energy House) by 2030, which will significantly improve the insulation performance of the house and also make it highly efficient. After achieving significant energy savings through the introduction of advanced equipment systems, there will be a need to further introduce renewable energy equipment (hereinafter referred to as renewable energy equipment). All of the detached houses we supply in our group have obtained a grade 4 or higher in the "insulation performance grade" and a grade 5 or higher in the "primary energy consumption grade" of the Housing Performance Indication System. In addition, according to the standards as of March 2023, approximately 80% of the homes supplied by our group meet the even higher ZEH standard of "insulation performance grade 5" and "primary energy consumption grade 6." , even if energy conservation standards are raised, we expect the impact of additional investment and cost increases to be limited. In addition, as mentioned above, our group procures a wide variety of construction materials, and due to emissions regulations due to the introduction of carbon taxes, soaring prices of electricity derived from fossil fuels due to global decarbonization efforts, and emissions trading. Costs are expected to increase due to introduction and green power purchase, etc. The impact of these additional cost increases is judged to be "moderate."

[Policies/Legal Regulations] Mandatory installation of renewable energy equipment

Regarding the mandatory installation of renewable energy equipment, an increasing number of local governments are making it mandatory to install solar power generation equipment, etc. when building, expanding or renovating buildings over a certain size. It is scheduled to come into force first in Tokyo in 2025, and will impose obligations on installation businesses such as house builders of a certain scale. Because additional equipment and installation costs are incurred, there is concern that depending on support measures such as subsidies and tax breaks provided by the national and local governments, the financial burden on buyers will increase and demand for housing will decline. In addition, we believe that the financial impact will be significant as it will be a factor that will reduce the profit margin of our group.

[Research and development investment] Development of low-carbon housing

Regarding renewable energy equipment, we do not only rely on suppliers, but also conduct research and development of artificial photosynthesis technology in-house and promote efforts toward practical application. At the same time, we will also consider third-party ownership models (hereinafter referred to as PPA models) for renewable energy equipment and the development of affiliated mortgage loans, in order to create a system that reduces the financial burden on buyers. We believe that the impact of additional cost increases due to R&D investment will not be significant.

[Policies/Legal Regulations] Carbon tax/carbon emissions regulations

Regarding the carbon tax, if we assume it to be around 17,000 yen/t-CO2, the financial impact on our group would be "medium", and we would like to further reduce GHG emissions from construction sites and factories and use eco-friendly cars. In addition to implementing reduction measures such as promotion, we will reduce GHG emissions throughout the value chain by reviewing material procurement conditions and product development.

[2] 4℃ scenario

[Extreme weather changes] Impact on construction sites

The 4℃ scenario assumes sudden changes in weather conditions such as typhoons and floods, increases in average temperature, and changes in precipitation patterns, which may have an impact on business activities. Although our group supplies a large number of housing units, our development areas are scattered across the country, and our development scale (the number of housing units supplied per site) is small, so we bear the burden of restoration costs. , risks such as interest costs due to construction delays and loss of sales opportunities are diversified.

[Extreme weather changes]

Impact on supply chain

The same risks as above can be assumed in the event that a material supplier is forced to suspend operations due to a disaster or the supply chain is disrupted. We are promoting diversification, etc., and are working to reduce risks.

2. Forest related business

As forests are directly affected by climate change and are a major source of materials for single-family homes, our group could be financially affected significantly. On the other hand, our group owns approximately 4 million hectares of forest resources in the Khabarovsk region of Russia's Far East, and the use of forest resources is one of the effective means of reducing CO2 emissions, and we hope to expand the range of uses for wood in the future. We expect this to become a promising business opportunity for our group.

[1] 1.5℃ scenario

[Procurement] Material procurement costs

In the 1.5℃ scenario, aggressive CO2 reduction measures will be promoted worldwide, and demand for wood that can fix CO2 is expected to increase. As a result, it is assumed that timber procurement prices will rise, but our group has enough forest resources (cutting permit amount) to supply 50,000 to 60,000 homes annually. Therefore, we believe that the financial impact on a consolidated basis can be kept low.

[Market] Expanding demand for wood

It is expected that the use of wood will expand to include high-rise buildings that have not traditionally used wood, and that demand for wood pellets used in biomass power generation will expand, creating a business opportunity for our group in the forestry business. I hope it will be.

[Market] Carbon credits

It is possible to increase the CO2 absorption capacity of our forest resources through appropriate maintenance and management and systematic afforestation. At present, credits related to forest conservation are not subject to offset under the GHG Protocol, so the financial impact cannot be factored in. However, in the future, it has the potential to become a major business opportunity. (As this is a highly reliable factor, we have not estimated the financial impact.)

[2] 4℃ scenario

[Average temperature] Impact on forest growth environment

In the 4℃ scenario, increases in average temperature are expected to cause forest fires, outbreaks of pests, etc., and changes in the forest growing environment are also expected to lead to risks such as lengthening of the growing season and changes in material quality. Regarding the overseas forests owned by our group, it is thought that the temperature increase by 2050 will not be high enough to have a significant impact on forest cultivation compared to the current level, so there will be no significant financial impact. I judge that there is no.

Impact analysis results of climate-related risks and opportunities

[Risks due to climate change]

| Scenario classification | Business risks due to climate change | Potential financial impact | Actualized period | Financial impact |

|---|---|---|---|---|

| 1.5℃ (Transition risk) | [Policies/Legal Regulations] Carbon tax/carbon emissions regulations | Assuming that the carbon tax is approximately 17,000 yen/t-CO2, the tax increase will have the effect of lowering profits (profit margin). | Middle period | During ~ |

| [Policies/Legal Regulations] Energy saving/low carbon regulations | If the insulation standards for housing are raised, additional costs will be incurred, which will have the effect of lowering profits (profit margin), but we have already ensured that all of the housing we supply have insulation performance grade 4 or higher under the Housing Performance Indication System. In addition to obtaining a primary energy consumption grade of 5 or higher, approximately 80% of the homes it supplies have already achieved the ZEH standard, so the impact can be kept within the "medium" range. | Short term | During ~ | |

| [Policies/Legal Regulations] Obligation to install renewable energy equipment | If ZEH is made mandatory for newly built single-family homes, the cost of installing renewable energy equipment will increase the selling price, and depending on subsidies and tax incentives, this will not only reduce housing demand but also increase profits ( This could lead to a decline in profit margins.) | Short term | Big | |

| [Research and development investment] Development of low carbon housing | It is expected that there will be a demand for low-carbon housing with higher insulation performance and lower energy consumption, but we are already systematically promoting research and development aimed at responding to ZEH, etc. The financial impact of major investments and expenses is small. | Short term | Small | |

| 【market】 Changes in customer needs and purchasing behavior | Ethical consumption orientation is spreading to the housing sector, and it is expected that corporate activities, including environmental measures, will have a significant impact on consumer purchasing decisions. The financial impact of investments and expenses is small. | Middle period | Small | |

| [Procurement] Increase in material procurement costs | As global warming countermeasures accelerate, the demand for wood that can fix CO2 will increase, and wood prices are expected to rise. However, as we own our own forest resources, we are unable to consolidate the Group. The financial impact on a base basis is limited. | Middle period | During ~ | |

| 4℃ (Physical risk) | [Extreme weather changes] Impact on construction site | Although recovery costs and the risk of delivery delays are expected due to damage to construction sites, our company is financially stable because the scale of each construction site is small and our sales area is spread across the country, which allows us to diversify risks. The impact is small. | Short term | Small |

| [Extreme weather changes] Impact on supply chain | In the event that a supplier factory is affected by a disaster and operations are halted or the supply chain is disrupted, this could have a financial impact, such as delays in housing delivery due to construction delays or an increase in interest costs on loans. | Short term | During ~ | |

| [Changes in precipitation patterns] Impact on our material factories | Although damage from river flooding and inland water is expected, the risk of long-term suspension of operations is low due to the location of our factory, and the financial impact will be small. | Middle period | Small | |

| [Increase in average temperature] Impact on work at the construction site | There is a risk of decreased work efficiency at construction sites, increased costs for health damage caused by heatstroke, and delays in delivery, but the financial impact is small. | Middle period | Small | |

| [Increase in average temperature] Impact on forest growing environment | It is expected that the growing environment for coniferous trees used in housing construction will change, but assuming 2050, the impact will be limited and the financial impact will be small. | Long term | Small |

[Opportunities due to climate change]

| Scenario classification | Business opportunities due to climate change | Potential financial impact | Actualized period | Financial impact |

|---|---|---|---|---|

| 1.5℃ | [market] in the detached house market Growing demand for low-carbon housing | The detached house market has been slow to respond to ZEH, but our company has already implemented insulation and reduction of primary energy consumption, so the additional cost required is relatively small, so the sales price is relatively low. This will increase the company's competitive advantage and create an opportunity to expand the number of buildings sold. | Middle period | Big |

| [market] Expanding demand for wood | As measures to reduce greenhouse gases are strengthened, demand for wood that can fix CO2 is expected to increase. If new demand for wood is created for high-rise buildings that have not traditionally used wood, sales of the company's wood business are expected to expand. | Middle period | Big | |

| [market] Through artificial photosynthesis technology Expansion of application fields | Artificial photosynthesis technology not only does not emit CO2, but also absorbs it, making it more environmentally effective than solar panels. If we can develop a device with higher power generation efficiency per unit cost than alternative methods, we can expect to increase the added value of homes and increase sales of the device alone. | Middle period | Small | |

| [market] Improving the appeal value of wooden houses | Our group fixes 600,000 tons of CO2 annually through the construction of 45,000 wooden houses. The appeal value will increase as consumers become more environmentally conscious, which is expected to have a positive impact on sales of our homes. | Short term | Small | |

| [market] Contributing to the environment by utilizing forest resources | Owned forest resources are management resources that contribute to the fixation of CO2, and their appeal to environmentally conscious consumers is high. | Short term | Small | |

| [market] Creating CO2 credits through forests | If forest credits can be used to reduce GHG emissions in the future, a direct financial effect is expected (however, as it is currently uncertain, we have not estimated the financial impact). do not have). | Short term | - |

Against climate-related risks and opportunities

Strategic/financial planning

1. Our group's strategic policies and countermeasures

Based on our business concept of "realizing a society where everyone can afford to own a home," our group has provided Customer with living environments where they can live in safety, comfort, and health. We believe that this business concept of "something everyone should take for granted" is extremely important in realizing a sustainable society. Our company believes that in order to prevent global warming, it is not enough for only a few environmentally conscious companies and consumers to take action; this theme can only be achieved if all companies and consumers participate in the efforts. The group is thinking.

Based on this idea, we aim to make products and services with high environmental performance readily available to everyone, in other words, to balance the cost burden necessary for environmental measures with affordability that everyone can enjoy. This is a key strategic theme for our group. Our group's main strategic policies toward our goal of achieving carbon neutrality in 2050 are as follows.

[1] Compatibility with ZEH standards for single-family houses supplied

Our group has already obtained a rating of 4 or higher in the "Insulation Performance Class" and a 5 or higher rating in the "Primary Energy Consumption Class" of the Housing Performance Indication System for all the condominiums we supply. Based on legal and regulatory trends, our policy is to gradually increase the ZEH level (*3) compliance rate.

In addition, in preparation for the mandatory installation of renewable energy equipment, we are promoting research and development of power generation equipment that utilizes artificial photosynthesis technology. Our policy is to proceed with consideration of multiple options, including collaboration with suppliers.

At the same time, we are also considering developing PPA models and affiliated housing loans as a way to reduce the cost burden on Customer related to the installation of renewable energy equipment.

- *3 ZEH level means that the property satisfies the ZEH level (both "Insulation performance grade 5" and "Primary energy consumption grade 6") in the energy saving grade of the Housing Performance Indication System.

[2] Improving wood self-sufficiency rate

Demand for wood that can fix CO2 is expected to increase, so we are investing in processing lines to ensure that we can stably and cost-effectively procure the wood needed for single-family homes from our own forest resources. , we will build and strengthen logistics.

Furthermore, we view the demand for wood in new application fields as a business opportunity and aim to promote the spread of wood.

[3] Efforts to reduce GHG emissions

Our group's efforts to reduce GHG emissions include promoting energy conservation, introducing eco-cars, switching to renewable energy, introducing solar power generation in factories, and promoting wooden houses to fix and absorb carbon. In addition to forest conservation, our policy is to promote ZEH standard housing, reduce waste, and strengthen efforts to reduce emissions from the use and demolition of housing supplied by our group.

In addition, in order to achieve net zero, which means GHG emissions are virtually zero, it is essential to reduce emissions throughout the supply chain, including suppliers, and we are considering initiatives to reduce environmental impact in tandem with suppliers. We aim to achieve sustainable management.

[4] Strengthening BCP response in response to changes in the weather environment

Climate change is leading to more severe natural disasters such as large typhoons, storm surges, torrential rains, and inland flooding, resulting in factory shutdowns, lower operating rates, and supply chain disruptions, as well as increased daytime construction difficulties and work efficiency due to an increase in extremely hot days. There is a possibility of a decrease.

Continuously reviewing our BCP, such as strengthening collaboration with suppliers and securing decentralized procurement sources, will strengthen our business even in the event of an event that our group cannot deal with alone, such as a disaster in our supply chain. We will continue to strive to reduce climate change risks, recognizing that this is a measure to strengthen our management.

2. Our group's financial plan

When adding up the burden of investment funds for ZEH standardization of the housing we supply, development of renewable energy equipment, installation of processing lines for forest resources, development of logistics networks, etc., the financial burden on our group is expected to be large. It will be. However, as it is assumed that the scale of this will be covered within the scope of cash flow generated from business activities, we have determined that there is no need for additional financing at this time.

The impact on business results is a complex effect of various factors other than climate change factors (business confidence, financial markets, real estate market conditions, technology trends, existence of competitors, etc.), so only climate-related items are broken down into elements. Although it is difficult to make a comprehensive estimate, the results of comprehensive judgment are reflected in the medium-term management plan and annual plan.